Foreign exchange risk refers to the losses that an international financial transaction may incur due to currency fluctuations. Below are three different strategies to lower or remove a portfolios currency risk.

How To Manage A Short Term Currency Fluctuation Risk

How To Manage A Short Term Currency Fluctuation Risk

Exporting companies knows that foreign exchange risk can strongly affect their profit margins and cash flow but many arent very good at managing them.

Forex! fluctuation risk. Foreign exchange fluctuations risks in international business. Foreign exchange risk is an additional dimension of risk which offshore investors must accept. There are several methods to measure var three basic methods are.

I have written a couple of articles about exchange rate fluctuations in export import business in this web blog. Thus because of the long term structural nature taking action related to brexit would not be effective. Investors can accept this risk and hope for the best or they can mitigate it or eliminate it completely.

Foreign exchange risk also known as fx risk exchange rate risk or currency risk is a financial risk that exists when a financial transaction is denominated in a currency other than the domestic currency of the company. These risk management actions to be effective need to be initiated at the inception of the investment because they hedge long term structural risks. A! lthough official or nominal exchange rates tend to draw the mo! st attention what really matters to companies are.

Recent swings in global currencies have brought exchange rate risk back to the forefront for companies working with suppliers production or customers in different currencies. Despite the issuer s ability to pay the investor has lost a portion of his return because of the fluctuation of the exchange rate. The information provided here is part of export import online tutorial.

Whether youre an average investor who wants to mitigate currency risk or a more sophisticated one who wants to take advantage of currency fluctuations the forex world isnt for the faint of heart. The parametric method historical simulation and monte carlo simulation. 66 measuring exchange rate fluctuations risk using the value at risk 1 introduction value at risk is one of the most common methods used in risk measurement.

Currency Risk Management For Your Business Caxton Fx Business

Currency Risk Management For Your Business Caxton Fx Business

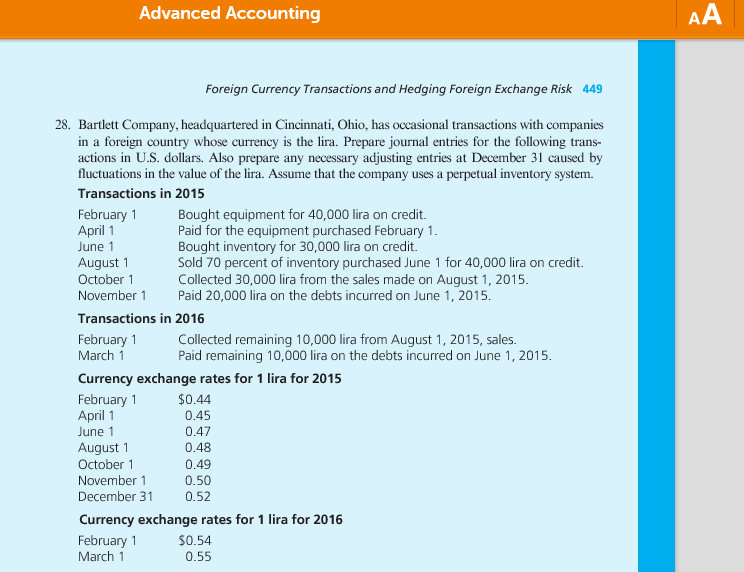

Solved Advanced Accounting Foreign Currency Transactions

Solved Advanced Accounting Foreign Currency Transactions

! What Is Currency Hedging Definition And Meaning Market Business News

! What Is Currency Hedging Definition And Meaning Market Business News

Guide To Managing Foreign Exchange Risk Toptal

Guide To Managing Foreign Exchange Risk Toptal

How To Manage Risk In Fx

How To Manage Risk In Fx

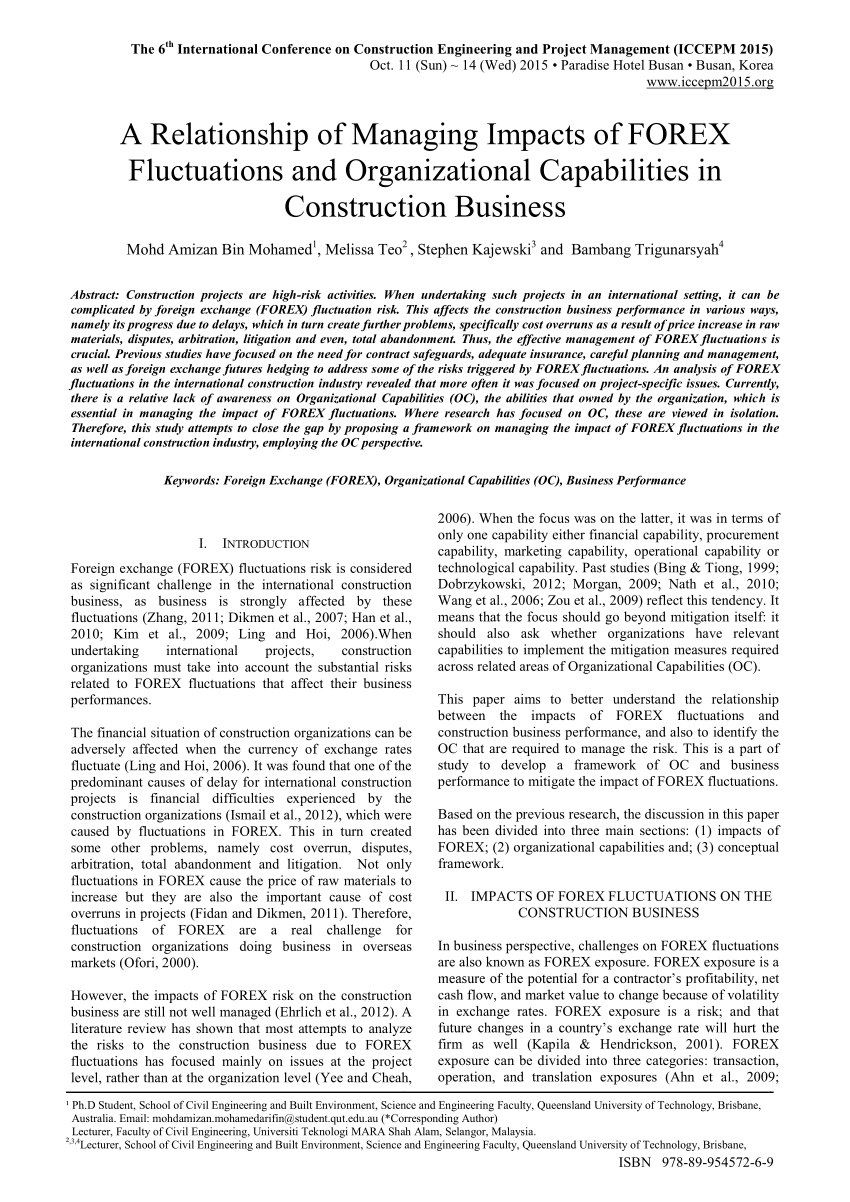

Pdf A Relationship Of Managing Impacts Of Forex Fluctuations And

Pdf A Relationship Of Managing Impacts Of Forex Fluctuations And

/close-up-of-information-sign-on-computer-monitor-1132270894-3ecbae38dbbb4c188154264fa75eb776.jpg) Currency Risk Definition

Currency Risk Definition

Currency Risk Here Is 5 Steps To Mana! ge Your Currency Risk

Currency Risk Here Is 5 Steps To Mana! ge Your Currency Risk

Fx Market Outlook Q2 2019

Fx Market Outlook Q2 2019

Fx Risk Management By Netting Technique Why When How

Fx Risk Management By Netting Technique Why When How

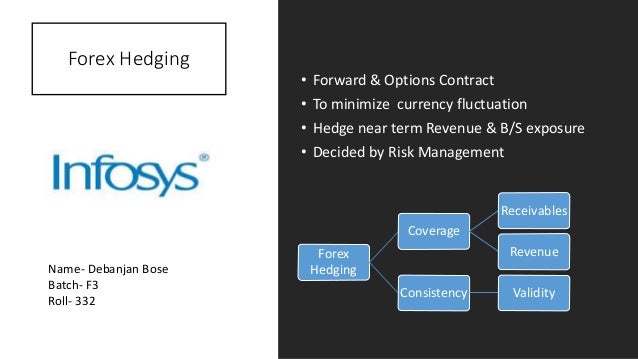

Forex Infosys

Forex Infosys

How Do Companies Mitigate The Risk Of Foreign Currency Chron Com

How Do Companies Mitigate The Risk Of Foreign Currency Chron Com

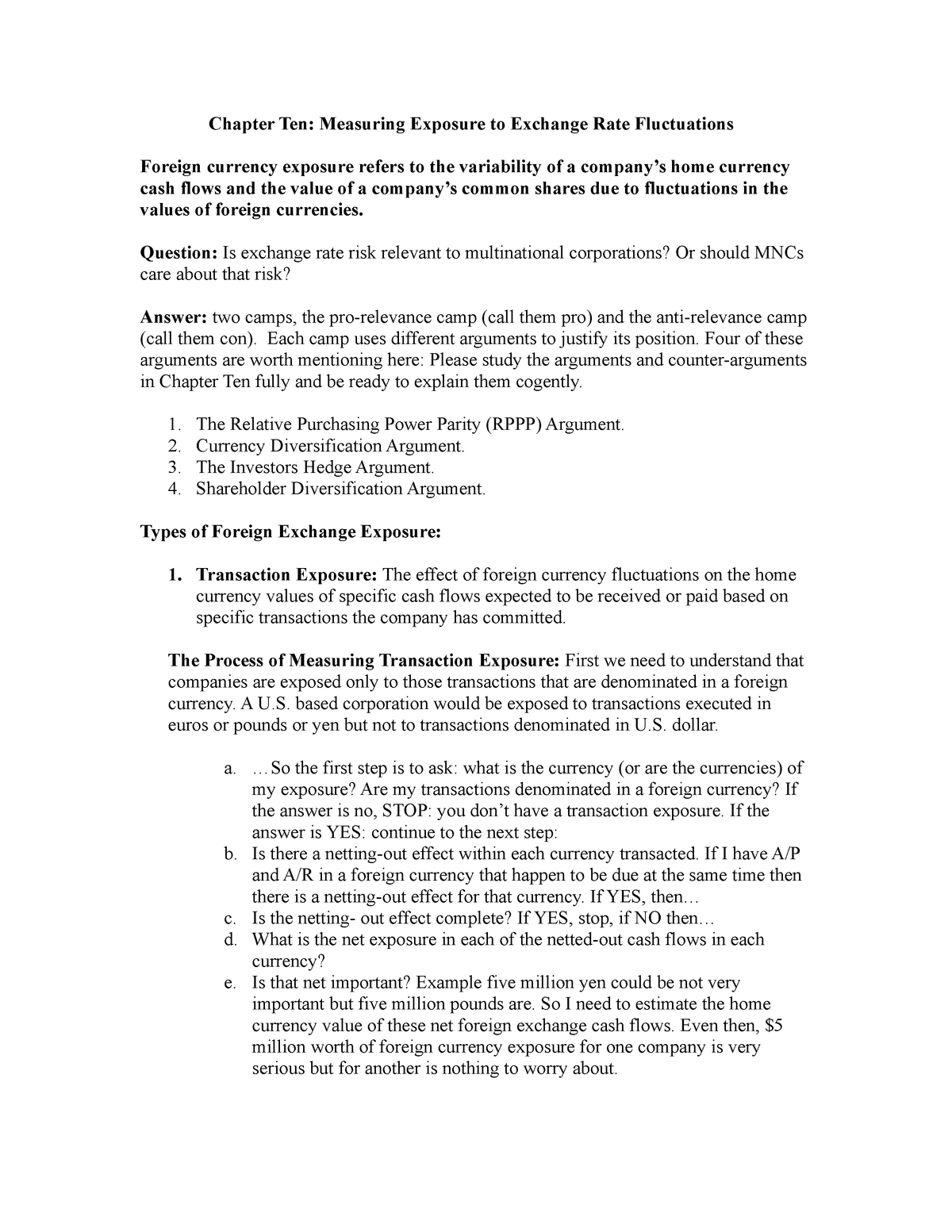

Chapter Ten Summary Measuring Exposure To Exchange Rate Studocu

Chapter Ten Summary Measuring Exposure To Exchange Rate Studocu

Foreign Exchange Risk Series E! ncorefx Canada

Foreign Exchange Risk Series E! ncorefx Canada

Balance Working Capital And Fx Risk Management Treasury Insights

Balance Working Capital And Fx Risk Management Treasury Insights

0 Response to "Forex Fluctuation Risk"

Posting Komentar