The canadian dollar is the currency most influenced by changes in the price of oil. Correlation filter type in the correlation criteria to find the least andor most correlated forex currencies in real time.

Forex Bond Correlation Investing Post

Canadas total oil reserves were 1789 trillion barrels a few years ago just below saudi arabia.

Oil forex correlation. The co! rrelation between forex oil and gold. Crude oil is quoted in us. Despite the history of correlation between cad and crude oil some believe the relationship is breaking down pointing to late 2018 when oils surge actually left cad behind.

Whenever retail interest peaks. The correlation between the canadian dollar vs us dollar and the oil price is very high. The correlation between oil and currencies is more complex than that which exists with gold.

Oil is the commodity par excellence. Demand falls manufacturers may decide to chill out since they dont need to make more goods. So each uptick and downtick in the dollar or in the price of the commodity generates an immediate realignment between the greenback and numerous forex.

To anticipate forex price fluctuations professional currency traders take a look at whats going on beyond the world of currencies. Due to its high industrial and geo strategic value its curr! ent and future price is very sensitive to news or rumors that ! may affect supply and demand. Relationship between crude oil and the forex market.

A little over one year ago i wrote an article about how to trade crude oil as there was a lot of interest in this primary energy commodity instrument at the time. Historically there is 075 080 positive correlation between cadusd and oil prices. Crude oil and forex market correlation usdcad cadjpy usdrub usdnok one of the most important forex and commodity correlation s exist between usdcad and crude oil.

Exchange rates are influenced by many factors supply and demand politics interest rates economic growth etc. There is again a lot of interest and these days a lot of forex brokers also offer trading in crude oil. Demand for oil might fall which could hurt demand for the cad.

Oil has a negative correlation with usdcad of about 93 between 2000 through 2016. Understanding why the dollar has historically traded inversely to the pri! ce of oil and why the correlation has weakened recently can help traders make more informed trading decisions as the global economy continues to evolve. Correlation ranges from 100 to 100 where 100 represents currencies moving in opposite directions negative correlation and 100 represents currencies moving in the same direction.

When oil goes down usdcad goes up. When oil goes up usdcad goes down. Some currencies are highly correlated with commodity prices as economic growth and exports are directly related to the counrtys domestic industry.

Forex Markets Correlation Ichi360 S Forex Trading

Forex Markets Correlation Ichi360 S Forex Trading

Forex Correlation Pdf Forex Kuopio

Intermarket Relationships In Forex Analytical Trader

Intermarket Relationships In Forex Analytical Trader

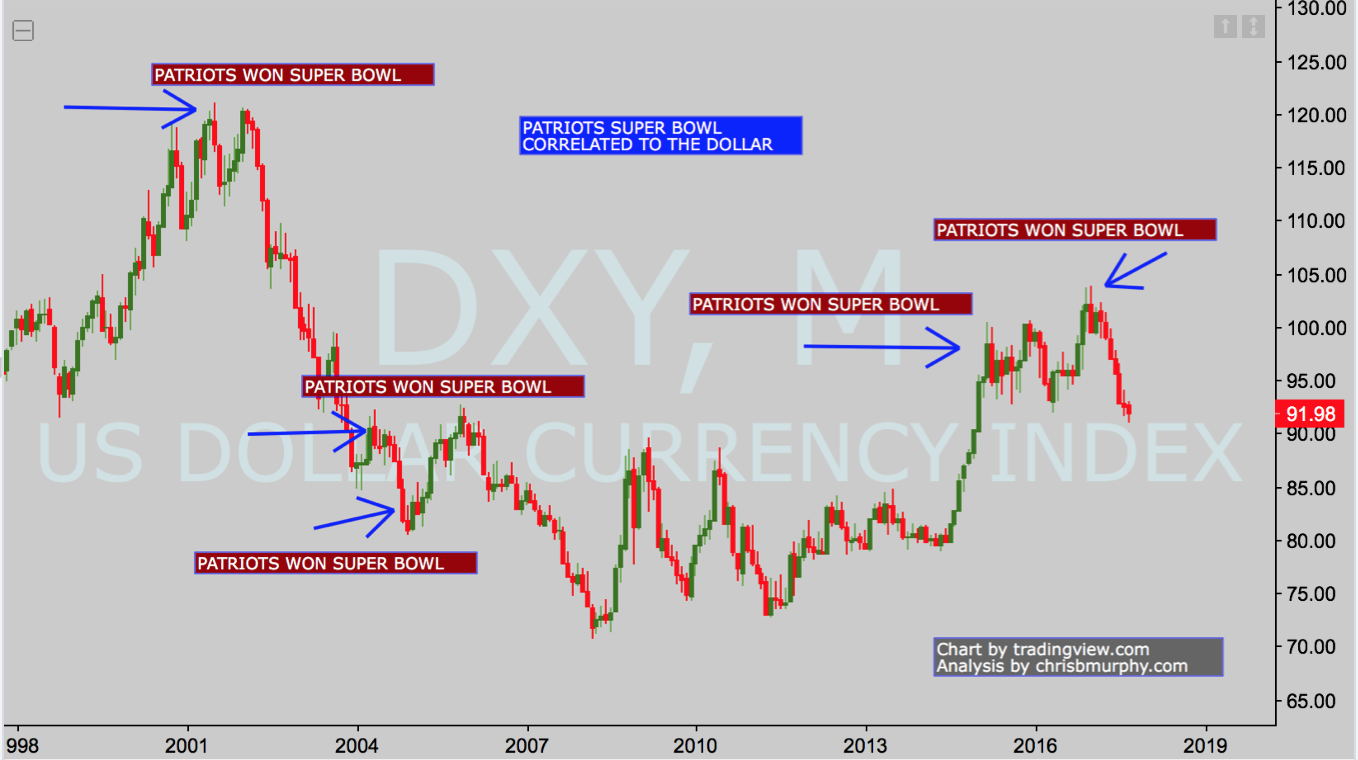

Crude Oil And Why The Correlation To The Dollar Is A Farce Seeking

Crude Oil And Why The Correlation To The Dollar Is A Farce Seeking

Forex Correlations Australian Dollar Proxy For S P 500 Gold Oil

Forex Correlations Australian Dollar Proxy For S P 500 Gold Oil

.png) What Is Currency Correlation And How Do You Use It

What Is Currency Correlation And How Do You Use It

Forex Correlation Examples To Lower Your ! Trading Risk The Secret

Forex Correlation Examples To Lower Your ! Trading Risk The Secret

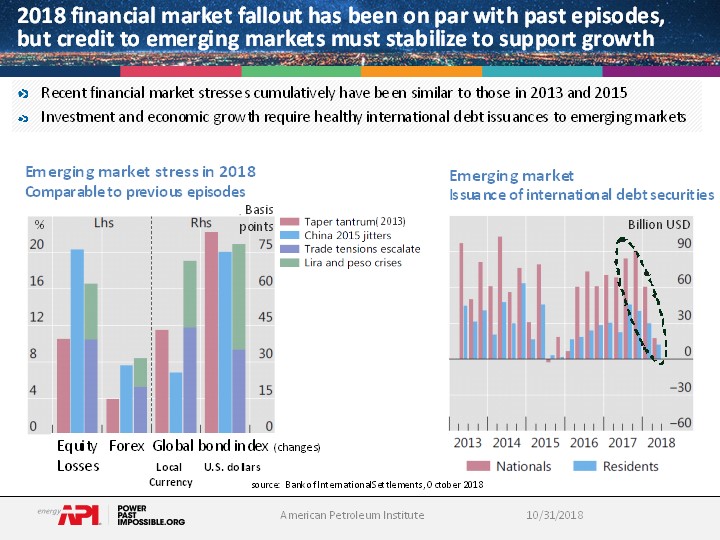

Api Correlation Grows Between Financial Markets Oil Prices

Api Correlation Grows Between Financial Markets Oil Prices

5 World Currencies That Are Closely Tied To Commodities U S

Currency Pair Correlations Forex Trading Octafx

Currency Pair Correlations Forex Trading Octafx

Oil And Cad Correlation Explained Fxopen Forex Blog

Oil And Cad Correlation Explained Fxopen Forex Blog

Forex Market Correlations Oil Gold Forex Trading Strategies Day

Forex Market Correlations Oil Gold Forex Trading Strategies Day

Crude Oil And Usdcad Cadjpy Correlation

Crude Oil And Usdcad Cadjpy Correlation

How To Chart Forex Correlation Trading Heroes

Backtestmarket Forex And Commodities Correlation Blog

Backtestmarket Forex And Commodities Correlation Blog

0 Response to "Oil Forex Correlation"

Posting Komentar